Contractor's Liens in Texas: What You Need to Know

In Texas, it’s not unusual for construction projects to begin without a signed agreement in hand. Verbal commitments, handshake deals, or implied understandings often move a job forward, but what happens when payment doesn’t follow? Can a contractor file a lien without a contract in Texas? The short answer: sometimes, but only under specific legal conditions. Understanding those conditions helps protect your right to get paid.

Texas lien laws are strict. While a mechanic’s lien is a powerful tool for recovering unpaid labor or materials, missing documentation or deadlines can render it useless. According to recent updates in the Texas Property Code, even without a formal written contract, certain contractors may still qualify to file a lien under what’s known as an “implied contract” or as an “original contractor” with a direct contractual relationship to the property owner. This article clearly breaks down those rules, so you’ll know exactly where you stand and what steps to take next.

Why Understanding Mechanic’s Liens and Construction Liens in Texas Matters

Understanding how mechanic’s and construction liens work in Texas is essential for getting paid. Whether you’re a general contractor, subcontractor, or material supplier, knowing your lien rights and the steps to secure them can mean the difference between collecting full payment and walking away empty-handed. Texas law offers strong protection but only if you follow the process to the letter.

Legal Backing to Protect Your Rights

Texas law supports your right to file a mechanic’s lien. The construction lien involves strict deadlines and specific paperwork, but if done correctly, it provides a powerful tool to get paid. Unpaid contractors have the right to place a lien on the property, making it harder for the owner to sell or refinance until debts are settled.

Filing a lien involves submitting an affidavit, listing the work performed, and notifying the property owner. Legal backing for these actions comes from the Texas Property Code, Chapter 53, which outlines detailed requirements and protections.

Understanding Contractor’s Liens in Texas

A contractor’s lien (also called a mechanic’s lien or construction lien) is a legal safeguard that helps construction professionals recover unpaid funds for their work. When a property is improved but full payment hasn’t been made, this lien allows contractors, subcontractors, and suppliers to assert a claim directly against the real property itself. It’s a critical tool in the construction industry, designed to protect those who invest their time, labor, or materials into a project and ensure their right to fair compensation.

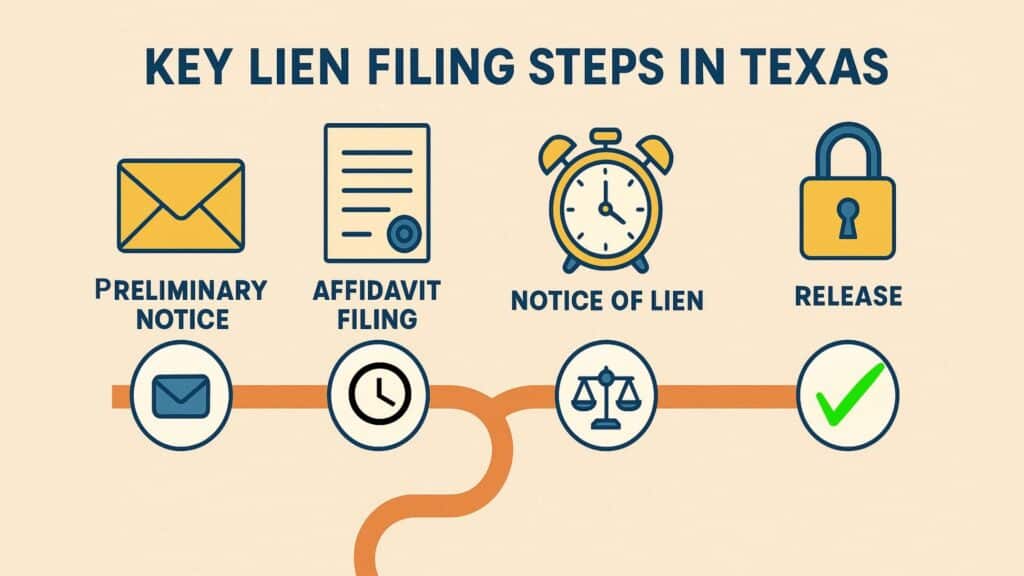

Key Requirements for Filing a Lien and Preliminary Notice

When filing a mechanic’s lien in Texas, the process is governed by specific rules and deadlines. Missing any of these can result in losing your right to file a lien. Here are the key requirements:

Pre-Lien Notices: If you’re a subcontractor or supplier, you need to send pre-lien notices. For instance, first-tier subcontractors must notify the property owner by the 15th day of the third month after the unpaid work or materials were provided. For residential projects, this deadline is the second month.

Affidavit Requirements: The lien affidavit must include a sworn statement of the claim amount, the owner’s name and address, a general description of the work done, and more. Importantly, it must be notarized as “subscribed and sworn to.”

Filing Deadlines: For non-residential projects, the lien affidavit must be filed with the County Clerk by the 15th day of the fourth month after the debt accrues. For residential projects, the deadline is the 15th day of the third month.

Notice of Lien: Once the affidavit is filed, you must notify the property owner within five calendar days.

Eligibility Rules for Filing a Contractor’s Lien in Texas

Texas has a broad definition of who can file a mechanics’ lien. Contractors include those providing labor or materials, custom-fabricated materials, landscape services, demolition services, and design services like architecture and engineering. Mechanic’s liens are not applicable to public construction projects, which are defined as projects owned by governmental agencies.

General Contractors: General contractors can file a lien without a pre-lien notice. They file what is known as a “constitutional mechanic’s lien,” which is self-executing.

Subcontractors and Suppliers: Subcontractors and suppliers must send pre-lien notices. First-tier subcontractors (those contracting directly with the general contractor) have different notice requirements compared to second-tier subcontractors (those further down the chain).

Specially Fabricated Items: If you provide specially fabricated items, you must send a notice to the owner and the general contractor by the 15th day of the second month after the items were delivered.

Residential Construction: Filing a lien on a residential project, especially if it’s a homestead, has additional requirements. For example, the notice must include specific statutory language to inform the homeowner of their rights and obligations.

Residential Construction Projects vs. Commercial Projects

The rules for filing a lien in Texas vary depending on the type of property, and understanding these differences is essential. Residential construction projects, especially those involving homestead properties, are subject to more restrictive requirements and tighter deadlines than commercial ones.

For commercial projects, lien deadlines tend to be more forgiving. Subcontractors, for instance, generally have until the 15th day of the fourth month after the work was performed to file a lien affidavit. These projects often involve multiple parties and larger scopes, so the law allows more time for lien-related filings.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus

In contrast, residential projects (like new builds, remodels, or repairs on homes) require faster action. Subcontractors must send a pre-lien notice by the 15th day of the second month and file their lien affidavit by the 15th day of the third month. If it’s a residential homestead property, even stricter rules apply, including a written contract signed by both spouses (if married) and filed with the county clerk. Failing to follow these steps can invalidate a lien entirely.

Knowing the difference between project types helps you meet the correct deadlines and file a legally sufficient lien before your right to payment slips away.

Can a Contractor File a Lien Without a Contract in Texas?

Yes, but it depends on the type of contract and the contractor’s relationship to the project. Under the Texas Property Code, a contractor doesn’t always need a formal written contract to assert lien rights. In some cases, a verbal agreement or even an implied contract can be enough as long as there’s clear evidence that labor or materials were provided and the work contributed to improving the property.

That said, this only applies to certain roles. Original contractors (those who contract directly with the property owner) may file what’s known as a constitutional lien, which doesn’t require prior notice or a written agreement. However, if you’re a subcontractor or supplier, you must have a documented chain of agreements leading back to the owner, and you’re still required to send pre-lien notices and follow strict timelines. Without these, your lien may not be legally enforceable, even if the work was completed and unpaid.

The takeaway? Texas law may allow a contractor to file a lien without a written contract, but it’s a risky move without proof of performance, payment terms, and property improvement. If you’re relying on a handshake deal, be prepared to back it up with records like invoices, time logs, photos of work completed, or communication with the owner. When in doubt, having even a simple written agreement can make the difference between getting paid and losing your lien rights altogether.

nec ullamcorper mattis, pulvinar dapibus leo.

Parties Involved in a Contractor’s Lien

Behind every contractor’s lien is a web of players, each with a specific role that can influence how the claim unfolds.

- Claimant: The contractor or supplier who files the lien to secure payment for their services or materials.

- Hiring Party: The person or entity that contracted with the claimant to work on a project.

- Property Owner: The party or entity that holds the legal title to the property being improved.

- Lender: The financier of the construction project, if any, who may have a vested interest in the property.

- General Contractor: The contractor who oversees the entire project and coordinates the work of subcontractors and suppliers.

Knowing who’s who and what each party is responsible for can make all the difference when navigating the lien process and protecting your interests.

Property Owners’ Rights and Obligations

Property owners have specific rights and obligations when it comes to contractor’s liens:

Rights:

- Receive Notice: Property owners have the right to receive notice of a contractor’s lien claim, ensuring they are informed of any potential claims against their property.

- Contest Validity: They can contest the validity of a lien claim if they believe it is unjustified.

- Request Lien Waiver: Property owners can request a lien waiver or release from the contractor once payment is made.

- Release Property: They have the right to pay the amount claimed in the lien to release the property from the lien.

Obligations:

- Timely Payment: Property owners must pay contractors and suppliers in a timely manner to avoid lien claims.

- Licensed Contractors: They should ensure that all contractors and suppliers are properly licensed and insured.

- Accurate Description: Owners must provide a clear and accurate description of the property in the construction contract to avoid any disputes.

By understanding these rights and obligations, property owners can better manage their projects and avoid potential legal issues.

Contractors’ Rights and Obligations

Contractors also have specific rights and obligations regarding contractor’s liens:

Rights:

- File a Lien: Contractors have the right to file a contractor’s lien claim against a property if payment is not made for their services or materials.

- Receive Payment: They are entitled to receive payment for labor, services, materials, or equipment furnished in the construction industry.

- Contest Lien Waiver: Contractors can contest the validity of a lien waiver or release if they believe it’s not justified.

Obligations:

- Preliminary Notice: Contractors must provide a preliminary notice to the property owner before filing a lien claim, informing them of the intended work and potential lien.

- Timely Filing: They must file a lien claim within the required timeframe to ensure it is enforceable.

- Lien Waiver: Upon receiving final payment, contractors are obligated to provide a lien waiver or release to the property owner.

By adhering to these obligations, contractors can protect their lien rights and ensure they’re compensated for their work.

Navigating the Filing Process

Filing a Texas mechanic’s lien requires filling out forms, but more importantly, it’s about meeting exact legal requirements at the right time. From notices to affidavits, each step serves a specific purpose to validate your claim. Understanding how and when to act can be the key to turning unpaid work into secured payment.

Preliminary Notice Requirements

A preliminary notice informs the property owner of the intended work of a contractor, subcontractor, materials supplier, or equipment lessor. This notice must be sent within a specific timeframe, typically 20 days after beginning work on the project. The preliminary notice must include the following information:

- Claimant’s Information: The name and address of the claimant.

- Hiring Party’s Information: The name and address of the hiring party.

- Property Description: A clear description of the property where the work is being performed.

- Amount Claimed: A statement of the amount claimed for the work or materials provided.

Failure to provide a preliminary notice within the required timeframe can result in the loss of lien rights, making it impossible to secure payment through a lien. Therefore, contractors and suppliers must understand and comply with preliminary notice requirements to protect their financial interests.

Enforcing Liens, Releasing Liens, and Lien Waivers

Once a lien is filed, the work isn’t over. To actually recover payment or clear the lien, you’ll need to follow through with enforcement or formally release the claim. Whether you’re pursuing a lien or resolving one, understanding these final steps is essential to closing the loop legally and effectively.

Sending Notices

In Texas, sending lien-related notices is a legal safeguard that activates your right to payment. These notices alert property owners early in the process, giving them a chance to address unpaid claims before things escalate.

For subcontractors and suppliers, it’s also a way to “trap funds,” ensuring money still held by the owner can be legally set aside to cover your invoice. While general contractors don’t need to send pre-lien notices, everyone else must meet strict deadlines, and delivery must be via certified mail with return receipt requested to prove compliance. If you miss a notice, you may lose your lien rights, even if the work was done and the debt is valid.

The Third Month Notice and Fund Trapping Explained

The third-month notice, also known as a fund-trapping notice, is a powerful tool under Texas lien law, especially for subcontractors and suppliers. By sending this notice on time, you legally compel the property owner to withhold enough contract funds from the general contractor to cover your unpaid claim. Fund trapping protects your right to payment in situations where the contractor may default or fail to pass funds down the chain.

Texas only requires a 10% retainage by law, which may not be enough to cover all outstanding invoices. This notice ensures there’s a financial safety net in place before payments are finalized. Skipping or delaying this step can leave you without recourse if the money runs out.

Notice for Specially Fabricated Items

For specially fabricated materials, the notice must be sent by the 15th day of the second month after receiving and accepting the order. This notice must include the contract price and be sent via registered or certified mail to the owner and, if applicable, the original contractor.

Special Rules for Residential Homestead Properties

Residential homesteads (primary residences protected under Texas law) come with extra legal safeguards that make filing a lien more complex. If you’re working on a homestead property, the law holds contractors to a higher standard to prevent improper liens from being filed against a family’s home.

To preserve your lien rights, you must take these steps before work begins:

- Create a written residential construction contract that clearly outlines the work to be performed and the payment terms.

- Make sure the contract is signed prior to starting any labor or delivering materials.

- If the owner is married, both spouses must sign the agreement.

- File the signed contract with the county clerk in the county where the property is located.

Skipping even one of these steps can make your lien legally unenforceable, regardless of how much work was completed or how much is owed.

Enforcement

To enforce a lien, you may need to initiate foreclosure proceedings. This involves filing a lawsuit to force the sale of the property to recover the unpaid amount. It’s a drastic step, but sometimes necessary to secure payment.

Payment or Settlement

Often, the threat of a lien is enough to prompt payment or settlement. Make sure to keep all communications professional and courteous to maintain good relationships while protecting your rights.

Release of Lien

Once payment is received, you must release the lien. Texas law mandates the use of specific forms for releasing liens. There are two types: conditional (when payment is not yet made) and unconditional (when payment has been made). Using the correct form is essential, as any deviation can render the release invalid.

Partial and Final Lien Releases

Texas Property Code §§53.281 and 53.282 provide mandatory forms for partial and final lien releases. These forms must be used as-is, and any contract requiring a different form is unenforceable.

Mandatory Forms for Lien Releases

Texas law requires specific statutory lien release forms for both partial and final payments. These forms are standardized and must be completed exactly as outlined in the Texas Property Code. One commonly overlooked detail is the “job description” field. It may seem minor, but leaving it blank or vague can delay or invalidate your release. Accuracy is critical, and no substitutions or custom versions are allowed, even if agreed upon in a contract.

Because lien laws are highly technical, many contractors rely on trusted online platforms that guide them through each step of the process. These services offer clear instructions and automatic form generation while ensuring notices and affidavits meet Texas requirements without the high cost of hiring an attorney. For those seeking speed, compliance, and affordability, it’s a smart way to protect your mechanic’s lien rights and secure the payment you’ve earned.

Avoiding and Resolving Disputes

Disputes are common in the construction world, but letting them go unresolved can quickly escalate into mechanic’s liens, legal claims, or even lawsuits. Whether you’re a contractor or property owner, knowing how to handle conflict early can help you avoid bigger problems down the line. Here’s how to manage payment disputes before they become costly legal battles.

Negotiation

First things first: communication. If your contractor claims you owe extra money, don’t ignore their calls or invoices. Ignoring them can be seen as disrespectful and may escalate the situation. Instead, have a frank discussion about the disagreement. This can often resolve issues before they spiral out of control.

Mediation

If direct negotiation doesn’t work, consider mediation. Mediation involves a neutral third party, usually an attorney or someone with experience in the construction industry. They help both parties negotiate a fair settlement. This approach is less formal and less costly than going to court.

Settlement Strategies

Be open to creative settlement strategies. For instance, rather than paying a lump sum, you could agree to make payments over time. Instead of a monetary settlement, you might offer the contractor a public endorsement or reference. You could even negotiate a discounted payment in exchange for a limited scope of ongoing work.

Importance of a Well-Written Contract for the Property Owner

A well-written contract is your best defense against disputes. Make sure your contract includes:

- A detailed description of the work to be performed

- The timeline for completion

- The cost or how the cost will be determined

- The payment schedule

Put any promises or warranties in writing. An oral promise may not be enforceable under Texas law.

Legal Remedies

If all else fails, legal remedies are available. You can:

- Obtain a lien bond: This guarantees payment to the contractor if they win their legal claim, but it also removes the lien from your property record.

- Petition the court: You can ask the Texas District Court to remove the lien. Grounds for removal could include that the contractor never did the work claimed or that the work was already paid for.

- Attack legal deficiencies: Texas has strict deadlines for filing liens. If the contractor missed these deadlines, the lien can be stricken.

Litigation is time-consuming and expensive. Most contractors prefer to settle quickly for a reasonable sum. Use this leverage to your advantage.

Protect Your Payment Rights—Even Without a Written Contract

Navigating Texas lien laws can feel overwhelming, especially when there’s no formal contract in place. But whether you’re working under a handshake deal or a detailed agreement, knowing your rights and acting on them is key to securing the payment you’ve earned. From meeting notice deadlines to using the correct forms, every step matters when it comes to protecting your financial interests on a construction project.

At Texas Easy Lien, we’ve made the lien process simple, affordable, and entirely online. Whether you need to send a pre-lien notice, file a lien affidavit, or release a lien once you’ve been paid, our platform walks you through it in minutes. No legal jargon. No costly attorney fees. Just a fast, reliable way to secure what you’re owed. Start your claim today and take the first step toward getting paid with confidence.