Placing a lien on property in Texas requires following strict procedures and deadlines to secure payment for unpaid work or materials.

- Send required notices within specific timeframes based on your contractor type

- File the lien affidavit by the 15th day of the 3rd or 4th month after work completion

- Follow exact procedures or risk losing your right to payment through liens

- Use online tools to streamline the process and avoid costly attorney fees

When you’ve done the work but haven’t been paid, knowing how to put a lien on a property in Texas can be the difference between getting your money and eating the loss. A lien gives you a legal claim against the property until you get paid, and it’s one of the most powerful tools contractors have to secure payment.

The construction industry faces significant payment challenges. Eighty-two percent of contractors experience payment delays of over 30 days compared to 49% two years ago, while slow payments cost the industry $280 billion in 2024 alone. Understanding mechanic’s liens in Texas is essential for protecting your business.

Texas lien laws provide the legal framework that protects contractors, subcontractors, and suppliers when payment disputes arise. These laws establish clear procedures for securing your right to payment through property liens. The process involves specific notice requirements, strict deadlines, and proper filing procedures that must be followed exactly.

Why Do You Need to Know How to Put a Lien on a Property in Texas?

Understanding lien rights protects your financial interests when clients don’t pay. A properly filed lien encumbers the property, and if you need to put a lien on a house, it prevents the owner from selling or refinancing until your debt is resolved. In severe cases, liens can even force the sale of property to collect payment.

Texas construction lien laws serve multiple purposes. They protect contractors and suppliers from non-payment, ensure property owners know about unpaid debts, and provide a legal mechanism for resolving payment disputes. These laws balance the interests of all parties while giving contractors a powerful collection tool.

The Texas Property Code requirements are strict but straightforward. Original contractors, subcontractors, suppliers, architects, engineers, and demolition contractors can file liens when they provide labor or materials for property improvements. The key is following the procedures correctly and meeting all deadlines.

What Are the Deadlines for Filing a Lien in Texas?

Timing is everything when placing a lien on property in Texas. Miss the deadline, and you lose your right to file. The deadlines vary based on your role and project type:

| Role / Project Type | Pre-Lien Notice Deadline | Lien Affidavit Filing Deadline |

| Original Contractor – Commercial | None required | 15th day of the 4th month after completion, termination, or abandonment |

| Original Contractor – Residential | None required | 15th day of the 3rd month after completion, termination, or abandonment |

| Subcontractor / Supplier – Commercial | 15th day of the 3rd month after each unpaid month | 15th day of the 4th month after last work or scheduled delivery of specially fabricated materials |

| Subcontractor / Supplier – Residential | 15th day of the 2nd month after each unpaid month | 15th day of the 3rd month after last work or scheduled delivery of specially fabricated materials |

| Retainage Claims | Notice generally included in the contract or via monthly notices | 15th day of the 3rd month after the original contract is completed, terminated, or abandoned |

Don’t forget: A copy of the lien affidavit must be mailed to the property owner (and general contractor, if applicable) within 5 days after filing.

These deadlines are calculated from the last day you provided labor or materials, not when you sent invoices or when payment was due. For example, if you completed work in January, you must file your lien by May 15th for commercial projects or April 15th for residential projects.

How Do You Send Required Pre-Lien Notices?

Pre-lien notices are mandatory for subcontractors and suppliers before filing a lien. These notices inform property owners and general contractors about unpaid amounts and give them a chance to withhold funds to pay you directly.

The notice must include specific information:

- Your name and address

- The property owner’s name and address

- A description of work performed or materials supplied

- The amount owed

- The name of the original contractor.

Send notices by certified mail to ensure proof of delivery.

For commercial projects, send your notice by the 15th day of the third month after providing labor or materials. For residential projects, the deadline is the 15th day of the second month. This notice requirement doesn’t apply to original contractors who have direct contracts with property owners.

Many contractors miss these notice deadlines because they’re focused on completing the job rather than paperwork. Setting up systems to track deadlines can prevent costly mistakes that void your lien rights.

What Information Do You Need to File a Lien?

Gathering the correct information before filing prevents delays and rejections. You’ll need the property owner’s full legal name and mailing address, the project address including county, a legal description of the property, and details about the work performed or materials supplied.

Document the amount owed for each month you worked, including any unpaid invoices or change orders. If you’re a subcontractor, you’ll also need the general contractor’s name and address, plus information about any subcontractors above you in the chain.

The legal description of the property can often be found in your contract documents or obtained from the county clerk’s office. Many online lien services provide access to property databases that can help verify this information.

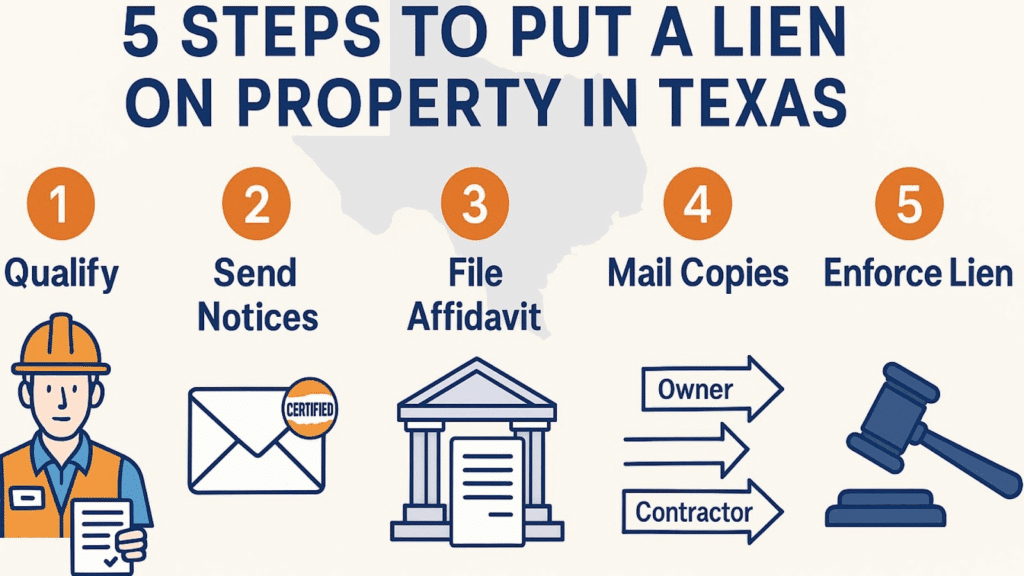

5 Critical Steps to Successfully Place a Lien on Property in Texas

If you’re wondering how to put a lien on property in Texas, here’s the process broken into clear steps. These rules come straight from the Texas Property Code and apply whether you need to put a lien on a house or a commercial project.

Step 1: Confirm you qualify

Not every contractor or supplier has lien rights. In Texas, original contractors, subcontractors, suppliers, design professionals, demolition crews, and providers of specially fabricated materials are eligible.

Step 2: Send required pre-lien notices (if you’re a subcontractor or supplier)

- Commercial projects: Notice due to the owner and general contractor by the 15th day of the 3rd month after each unpaid month.

- Residential projects: Notice due by the 15th day of the 2nd month after each unpaid month.

These notices must be sent by certified mail or another traceable delivery method.

Case Example: Wesco Distribution v. Westport Group (Tex. App.—Austin 2004)

A subcontractor lost their lien rights because the pre-lien notice was mailed with insufficient postage. The lesson: even small mistakes in notice delivery can invalidate your lien.

Step 3: File the lien affidavit with the county clerk

This is the formal lien filing in Texas. Deadlines depend on your role and project type:

- Original contractor, commercial: by the 15th day of the 4th month after project completion, termination, or abandonment.

- Original contractor, residential: by the 15th day of the 3rd month after completion, termination, or abandonment.

- Subs/suppliers: by the 15th day of the 4th month (commercial) or 3rd month (residential) after your last labor, delivery, or scheduled delivery of specially fabricated materials.

The affidavit must include the parties’ names, addresses, the amount owed, the months worked, and a legally sufficient property description.

Case Example: Perkins Construction v. Ten-Fifteen Corp. (Tex. App.—San Antonio 1976)

A contractor filed a lien affidavit but only listed a street address and failed to name the property owner. The court held the lien invalid because it didn’t meet the legal description requirements. The lesson: A street address alone is not enough. Always include a full legal property description and the owner’s information in your lien affidavit.

Step 4: Mail copies of the filed lien affidavit

Within 5 days after filing, send a copy of the lien affidavit to the property owner (and to the general contractor, if you’re a sub). Certified mail is safest.

Case Example: Blevins v. Andrews (Tex. App.—Houston [1st Dist.] 2010)

A claimant filed a lien affidavit on time but failed to mail copies to the owner and original contractor within five days. The court ordered the lien removed for failure to comply with notice rules. The lesson: Filing is only half the battle. Don’t forget to send copies within five days, or your lien could be thrown out.

Step 5: Enforce your lien if necessary

If payment still doesn’t come, you must file a lawsuit to foreclose the lien within 1 year after the last day you could have filed the affidavit. An owner and claimant can record an agreement to extend that deadline for up to one more year.

Special rule for homestead property (filing a lien on a house someone lives in):

You must have a written, signed contract recorded with the county clerk before work begins. If the owner is married, both spouses must sign.

How Do You Complete the Lien Filing Process?

The actual lien filing in Texas involves completing an affidavit of lien form with specific details about your claim. The affidavit must be signed under oath and include accurate information about the property, the work performed, and the amount owed.

Take the completed affidavit to the county clerk’s office where the property is located. Some counties allow electronic filing through approved services, which can speed up the process. Pay the required filing fees, depending on the county.

After filing, you’ll receive a stamped copy of the lien showing it’s been recorded in the public records, proof that you’ve officially put a lien on a house or commercial property. This recorded lien creates a cloud on the property title, preventing the owner from selling or refinancing without addressing your claim.

The final step is serving notice of the filed lien to the property owner and general contractor. This notice must be sent within five days of filing and should include a copy of the recorded lien affidavit.

What Happens After You File a Lien?

Filing the lien starts a clock for enforcement. You must file a lawsuit to foreclose on the lien within one year of the last day you could have filed the lien originally. This means planning ahead for potential litigation if payment negotiations fail.

Many property owners will contact you after receiving notice of the filed lien. Payment delays have become a significant industry issue, with liens serving as effective collection tools when many disputes are resolved through negotiation rather than litigation.

Keep detailed records of all payment discussions and any partial payments received. If you reach a settlement, make sure to file a lien release with the county clerk once payment is received in full.

How Do You Release a Lien After Getting Paid?

Once you receive full payment, you’re legally required to release the lien. File a lien release form with the same county clerk’s office where you filed the original lien. This removes the cloud from the property title and maintains good relationships with clients.

The release form must reference the original lien by its recording information and state that the debt has been satisfied. Some counties have specific release forms, while others accept a simple written release that meets legal requirements.

Failing to release a lien after payment can result in legal penalties and damage claims from the property owner. It’s also poor business practice that can hurt your reputation and future work opportunities.

What Are Common Mistakes That Invalidate Liens?

Missing deadlines is the most common mistake that voids lien rights. Texas courts strictly enforce the statutory deadlines, and there are very few exceptions for late filings. Knowing exactly how to put a lien on a property in Texas requires careful attention to timing requirements. Setting up calendar reminders and tracking systems prevents these costly errors.

Inaccurate property descriptions can also invalidate liens. The property must be properly identified using the correct legal description. Using only a street address may not be sufficient if it doesn’t match the legal description on file with the county.

Failing to send required notices or sending them to incorrect addresses can void your lien rights. Verify addresses through the contract documents or county records rather than relying on verbal information.

Incomplete or inaccurate lien affidavits create problems during enforcement. Double-check all information before filing, and make sure the sworn amounts match your actual records of unpaid work or materials.

How Can Technology Streamline the Lien Process?

Modern online platforms can automate much of the lien filing process, reducing errors and ensuring deadlines are met. These systems can track project timelines, generate required notices, and prepare accurate lien documents based on the information you provide.

Electronic filing systems are now available in many Texas counties, allowing you to file liens without visiting the county clerk’s office. This speeds up the process and provides immediate confirmation of filing.

Online notary services can handle the oath requirements for lien affidavits, eliminating the need to find a local notary. These services are available 24/7 and can complete the notarization process in minutes.

Digital record-keeping systems help track deadlines and maintain the documentation needed to support lien claims. These systems can send automatic reminders for notice deadlines and lien filing dates.

How Much Does It Cost to Place a Lien in Texas?

The costs of filing a lien include county filing fees, notary fees, and mailing costs for required notices. County filing fees vary by location, with Harris County charging $25 for the first page and $4 for each additional page, while other Texas counties may charge between $25 and $35 for the first page.

If you hire an attorney, legal fees can quickly add up to several thousand dollars for a simple lien filing. Online lien services offer a much more affordable alternative for routine filings.

Additional costs may include certified mail for notices and potential process server fees if personal service is required for certain notices.

Compare these costs to the amount you’re owed to ensure filing a lien makes financial sense. For smaller claims, the cost of enforcement through litigation may exceed the debt amount.

When Should You Consider Professional Help?

Complex projects with multiple contractors, disputed work quality, or unclear contract terms may benefit from legal guidance. An experienced construction attorney can review your situation and advise on the best approach for securing payment.

If you’re facing potential litigation to enforce a lien, legal representation becomes essential. Construction litigation involves specific procedures and evidence requirements that require professional expertise.

For routine lien filings on straightforward projects, online lien services provide a cost-effective alternative to hiring attorneys. These services guide you through the process while ensuring all legal requirements are met.

Consider professional help if you’re unsure about deadlines, notice requirements, or property descriptions. The cost of getting expert guidance is often less than the consequences of making mistakes that void your lien rights.

Frequently Asked Questions

Can I file a lien without a written contract in Texas? Yes, you can file a lien without a written contract in most cases. Texas lien law protects contractors who provide labor or materials based on oral agreements. However, written contracts provide better evidence and protection, especially for projects on homestead properties where written contracts are required.

How long does a lien stay on property in Texas? A lien remains on the property until it’s released or expires. You must file a lawsuit to enforce the lien within one year of the last day you could have filed the lien originally. If you don’t file suit within this timeframe, the lien becomes unenforceable.

Can property owners remove liens without paying? Property owners can challenge liens in court if they believe the lien is invalid due to missed deadlines, incorrect procedures, or other legal defects. They can also post a bond to have the lien removed from the property title while disputing the underlying debt.

What’s the difference between a pre-lien notice and a lien? A pre-lien notice is a warning sent before filing a lien, required for subcontractors and suppliers. It informs property owners about unpaid amounts and gives them a chance to withhold funds from the general contractor. A lien is the actual legal claim filed against the property after non-payment.

Can I file a lien on residential property in Texas? Yes, but residential properties have different requirements and shorter deadlines. Original contractors on homestead properties must have written contracts filed with the county before work begins. The deadlines for notices and lien filing are also shorter for residential projects.

Secure Your Right to Payment with Proper Lien Filing

Understanding how to put a lien on a property in Texas protects your business from non-payment and gives you the tools to collect what you’re owed. The process requires attention to detail and strict adherence to deadlines, but it’s manageable when you know the requirements.

Don’t let unpaid invoices threaten your business’s financial stability. Texas Easy Lien simplifies the entire lien process, from preparing accurate documents to filing with the county clerk. Our online platform guides you through each step while ensuring all legal requirements are met. Get started today and protect your right to payment.