Filing a lien on a property in Texas requires following strict deadlines and multiple steps to protect your payment rights.

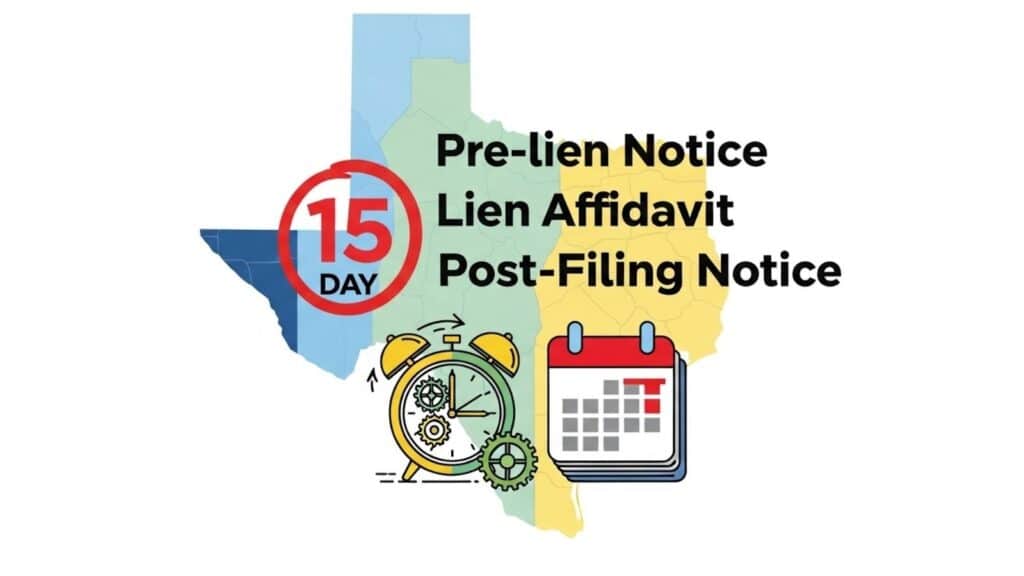

- Four-step process: Pre-lien notice, lien affidavit filing, post-filing notice, and potential enforcement

- Critical deadlines: 15th day of specific months based on work completion and contractor type

- 2025 updates: Weekend/holiday extensions, expanded delivery methods, and streamlined requirements

Use professional services to ensure compliance and avoid costly mistakes that void your lien rights.

Late payment continues to plague the construction industry, with contractors waiting an average of 83 days to get paid. For Texas contractors working on thin margins, filing a lien on a property in Texas is often essential for business survival. The mechanic’s lien remains the most powerful legal tool for securing payment on private commercial construction projects.

Recent changes to Texas Property Code Chapter 53 have streamlined some requirements while maintaining strict deadlines that can make or break your payment recovery efforts. Whether you’re a general contractor, subcontractor, or supplier, knowing the current process can mean the difference between getting paid and writing off thousands in unpaid work.

What Is a Mechanic’s Lien and Why Does It Matter?

A mechanic’s lien creates a legal claim against a property when contractors, subcontractors, or suppliers aren’t paid for work or materials provided. Under Texas law, this powerful tool prevents property owners from selling, refinancing, or transferring their property until the debt is resolved. For construction professionals, it’s the strongest available remedy for nonpayment on private projects.

The mechanic’s lien applies to general contractors, subcontractors, suppliers, engineers, architects, landscapers, and sub-subcontractors who contribute labor, materials, or professional services to a construction project. Once properly filed, the lien essentially gives you a stake in the property that can only be removed through payment or legal action.

Texas recognizes both constitutional and statutory liens. Constitutional liens apply automatically to contractors with direct contracts with property owners, while statutory liens under Chapter 53 provide broader protection for all parties in the construction chain, including those without direct owner relationships.

What Are the Legal Requirements for Filing a Lien on a Property in Texas?

Texas Property Code Chapter 53 establishes specific requirements for valid lien claims. The 2025 updates, building on major changes from HB 2237 (effective January 1, 2022) and S.B. 929 (effective May 21, 2025), have clarified several key provisions while maintaining strict compliance standards.

Eligibility requirements include providing labor, materials, or professional services that improve the property’s value. Design professionals like architects, engineers, and surveyors gained expanded lien rights in recent updates, no longer requiring direct contracts with property owners to file valid claims.

Documentation standards require accurate property descriptions, complete payment records, and proper service of all required notices. Any errors in essential information can invalidate an otherwise valid lien claim.

Project type distinctions impact filing requirements. Commercial projects generally allow longer deadlines, while residential projects have compressed timelines. Homestead properties require additional steps, including written contracts filed with the county clerk before work begins.

How Do You Calculate Lien Filing Deadlines in Texas?

Understanding lien filing steps in Texas starts with calculating the correct deadlines based on your role and project type. The 2025 updates added important flexibility. If any deadline falls on a Saturday, Sunday, or legal holiday, it automatically extends to the next business day.

For original contractors on commercial projects, the lien affidavit must be filed by the 15th day of the fourth month after completion, termination, or abandonment. For example, if a general contractor completed work in January 2025, their deadline would be May 15, 2025.

For subcontractors on commercial projects, the process involves multiple deadlines. They must send invoices by the 15th day of the second month following work completion, pre-lien notices by the 15th day of the third month, and file the lien affidavit by the 15th day of the fourth month after their last work.

For residential projects, all deadlines are compressed by one month. Original contractors must file by the 15th day of the third month after completion, while subcontractors must send pre-lien notices by the 15th day of the second month and file affidavits by the 15th day of the third month.

This contractor lien guide emphasizes that deadlines are calculated from the actual work completion date, not invoice dates or payment due dates. Proper calendar management is vital for protecting your lien rights.

What Information Must You Gather Before Filing?

Successfully filing a lien on a property in Texas requires gathering comprehensive project information before payment issues arise. Starting this documentation at the start of a project saves valuable time when deadlines approach.

Essential property information includes the owner’s complete legal name and current mailing address, the project’s physical address and county location, and the legal property description. For corporate owners, verify the exact business entity name and registered address.

Project documentation should include detailed records of work performed each month, materials supplied with delivery dates, and the total amount owed. Subcontractors need additional information about the general contractor and any higher-tier subcontractors in their payment chain.

Special requirements for homestead properties add complexity to the process. Before beginning work on an owner-occupied residential property, you must have a written contract signed by both spouses (if the owner is married) and filed with the county clerk. Without meeting these pre-work requirements, homestead lien rights cannot be established.

Contract documentation is particularly important when relationships aren’t formalized. Even verbal agreements can support lien claims if you can demonstrate that work was performed and improved the property’s value.

What Are the Four Essential Steps for Filing a Lien?

The complete process for filing a lien on a property in Texas involves four critical steps, each with specific requirements and deadlines that must be met precisely.

Step 1: Send Required Pre-Lien Notices

Subcontractors and suppliers must send pre-lien notices to both the property owner and general contractor. The 2025 updates unified notice requirements across all subcontractor tiers, eliminating previous distinctions between first-tier and second-tier subcontractors.

Notices must be sent via certified mail, registered mail, or any traceable delivery service that provides proof of receipt. The expanded delivery options offer more flexibility while maintaining the proof-of-service requirements essential for valid claims.

The notice must include specific information: your company name and address, a description of work performed or materials supplied, the project address, the amount owed, and the month(s) when work was performed. Using the standardized Notice of Claim for Unpaid Labor or Materials form helps ensure compliance.

Step 2: Prepare and File the Lien Affidavit

The lien affidavit serves as the formal legal document creating your claim against the property. This sworn statement must be filed with the county clerk in the county where the property is located, meeting strict deadline requirements based on your role and project type.

Required affidavit contents include the amount claimed, the property owner’s name and address, your contact information, the general contractor’s information, a legal description of the property, and details about all pre-lien notices sent. The affidavit must be notarized and properly indexed by the county clerk.

Filing fees vary by county but often start at a base of $25. Some counties accept electronic filing, while others require in-person submission. Checking your specific county’s requirements in advance prevents last-minute complications.

Step 3: Serve Post-Filing Notices

After filing your lien affidavit, you have exactly five calendar days to serve copies to the property owner and general contractor. This post-filing notice requirement is absolute. Missing this deadline invalidates your entire lien claim, regardless of how properly everything else was handled.

The notice can be a signed copy of the affidavit rather than a file-stamped version, providing some practical flexibility. However, service must still be via certified mail or another traceable method with proof of delivery.

Documentation is crucial at this stage. Keep all mailing receipts, delivery confirmations, and copies of served documents. These records prove compliance if your lien rights are later challenged.

Step 4: Enforce or Release the Lien

Filing a lien doesn’t automatically result in payment. It creates the legal framework for enforcement. If payment isn’t received after filing, you have one year from the last possible filing date to file a lawsuit to foreclose on the lien. This timeline was uniformly reduced to one year for all projects in recent updates.

Many contractors find that simply filing the lien motivates payment without requiring enforcement action. Property owners often cannot sell or refinance with active liens, creating strong incentives to resolve payment disputes quickly.

When payment is received, promptly filing a lien release clears the property records and maintains good relationships with property owners and general contractors. Release forms must be properly executed and filed with the same county clerk who recorded the original lien.

What Common Mistakes Should You Avoid When Filing?

Understanding potential pitfalls helps ensure your lien filing steps in Texas proceed smoothly without costly errors that void your payment protection. Recent law changes have simplified some requirements while maintaining strict standards in critical areas.

Deadline miscalculations are the most common and costly mistake. All deadlines are calculated from the actual work completion dates, not invoice dates or payment due dates. Missing any deadline, whether for pre-lien notices, affidavit filing, or post-filing service, can completely invalidate your lien rights.

Inaccurate Information frequently causes problems. Incorrect property descriptions, wrong owner names, or inaccurate work descriptions can provide grounds for challenging your lien’s validity. Double-check all information against official records and project documents before filing.

Errors in preparing or delivering your lien documents can open the door for others to dispute your claim. Always use traceable delivery methods for all notices and maintain comprehensive proof-of-service records. The 2025 expanded delivery options provide more choices while maintaining the requirement for verified delivery.

Homestead property complications catch many contractors unprepared. Filing a lien on a home in Texas where the owner lives requires meeting special pre-work contract requirements. Failing to complete these tasks before beginning work eliminates your ability to file a valid homestead lien later.

Frequently Asked Questions

Q: Can I file a lien without sending a pre-lien notice? A: Only original contractors with direct contracts with property owners can file liens without pre-lien notices. All subcontractors and suppliers must send proper pre-lien notices within the required deadlines to preserve their lien rights.

Q: What happens if I miss a lien filing deadline? A: Missing any statutory deadline typically voids your lien rights entirely. Texas courts strictly enforce these deadlines, and late filings generally cannot be corrected.

Q: How long do I have to enforce a lien after filing? A: You must file a lawsuit to foreclose on your lien within one year from the last date you could have filed the lien affidavit. This timeline applies to all projects under the 2025 updates and cannot be extended unless you enter a written agreement with the property owner.

Q: Can I file a lien on a homestead property? A: Yes, but only if you met special pre-work requirements, including a written contract signed by both spouses (if married) and filed with the county clerk before beginning work. Without meeting these requirements, homestead lien rights cannot be established.

Q: Do I need an attorney to file a mechanic’s lien? A: While attorneys aren’t required for filing liens, the complex requirements and strict deadlines make professional assistance valuable. Online services can provide guided assistance while reducing costs compared to traditional legal representation.

Q: What information must be included in a lien affidavit? A: Required information includes the amount claimed, the property owner’s name and address, your contact information, general contractor details, property description, work description, and documentation of all pre-lien notices sent. All information must be accurate and complete.

Protect Your Payment Rights with Professional Lien Services

Filing a lien on a property in Texas doesn’t have to be overwhelming. While the process involves multiple steps and strict deadlines, understanding your rights and following proper procedures can secure the payments you’ve earned. The 2025 updates have simplified some requirements while maintaining the strong protections that make mechanic’s liens such powerful collection tools.

Whether you’re dealing with a stubborn property owner, a cash-strapped general contractor, or simply want to protect your business from payment delays, having a reliable system for managing lien rights makes all the difference. Don’t let complex paperwork or confusing deadlines cost you thousands in unpaid work.

Texas Easy Lien streamlines the entire process with user-friendly online tools that guide you through each step, ensure deadlines are met, and professionally handle all filing requirements. From pre-lien notices to lien releases, our platform makes protecting your payment rights simple and affordable. Contact us today to secure the payments you’ve rightfully earned.